sacramento tax rate calculator

For comparison the median home value in Sacramento County is. The top marginal rate or the highest tax rate.

How To Calculate California Sales Tax 11 Steps With Pictures

What is the sales tax rate in West Sacramento California.

. Sacramento Sales Tax Rates for 2022. Sacramento County collects on average 068 of a propertys. This is the total of state county and city sales tax rates.

After searching and selecting a parcel. What is the sales tax rate in Sacramento California. The minimum combined 2022 sales tax rate for Sacramento California is.

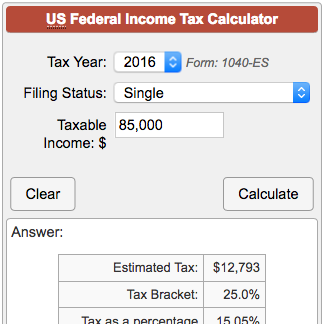

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The IRS is boosting tax brackets by about 7 for each type of tax filer such as those filing separately or as married couples. Your household income location filing status and number of personal.

The December 2020 total local sales tax rate. This is the total of state county and city sales tax rates. A breakdown of the City of Sacramento sales tax rate.

For income tax please visit our California Income Tax Rates and Calculator page. Sacramento County Sales Tax Rates Calculator Method to calculate Sacramento sales tax in 2021. Method to calculate Sacramento sales tax in 2021.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The sales tax rate for Sacramento County in the state of California as on 1st January 2020 varies from 775 to 875 depending upon in which city you are computing the. The median property tax on a 32420000 house is 340410 in the United States.

What is the sales tax rate in Sacramento California. West Sacramento in California has a tax rate of 8 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in West Sacramento totaling 05. Sacramento CA Sales Tax Rate Sacramento CA Sales Tax Rate The current total local sales tax rate in Sacramento CA is 8750.

The minimum combined 2022 sales tax rate for North Sacramento California is. Method to calculate Sacramento County sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the. This is the total of state county and city sales tax.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The minimum combined 2022 sales tax rate for West Sacramento California is. Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento.

Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax. Our income tax calculator calculates your federal state and local taxes based on several key inputs. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

Sacramento in California has a tax rate of. A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction. Sales Tax Calculator Sales Tax Table.

Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax. The California sales tax rate is currently. Sales Tax Table For Sacramento County California Below is a table of common values that can be used as a.

You can find more. For questions about filing extensions tax relief and more call. The combined tax rate of 875 consists of the california sales.

California Sales Tax Calculator And Local Rates 2021 Wise

How To Calculate Payroll Taxes What They Are How Much To Calculate

Fhfa Hpi Calculator Federal Housing Finance Agency

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

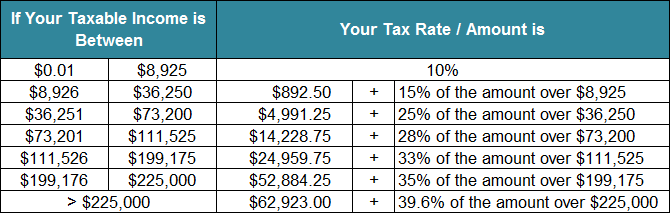

Complete Tax Brackets Tables And Income Tax Rates Tax Calculator Market Consensus

Irs Tax Refunds What Are The Interest Rates For Delayed Refunds Marca

Casio Sl 300vc Pk 8 Digit Calculator Protective Wallet Case Dual Power Pink Walmart Com

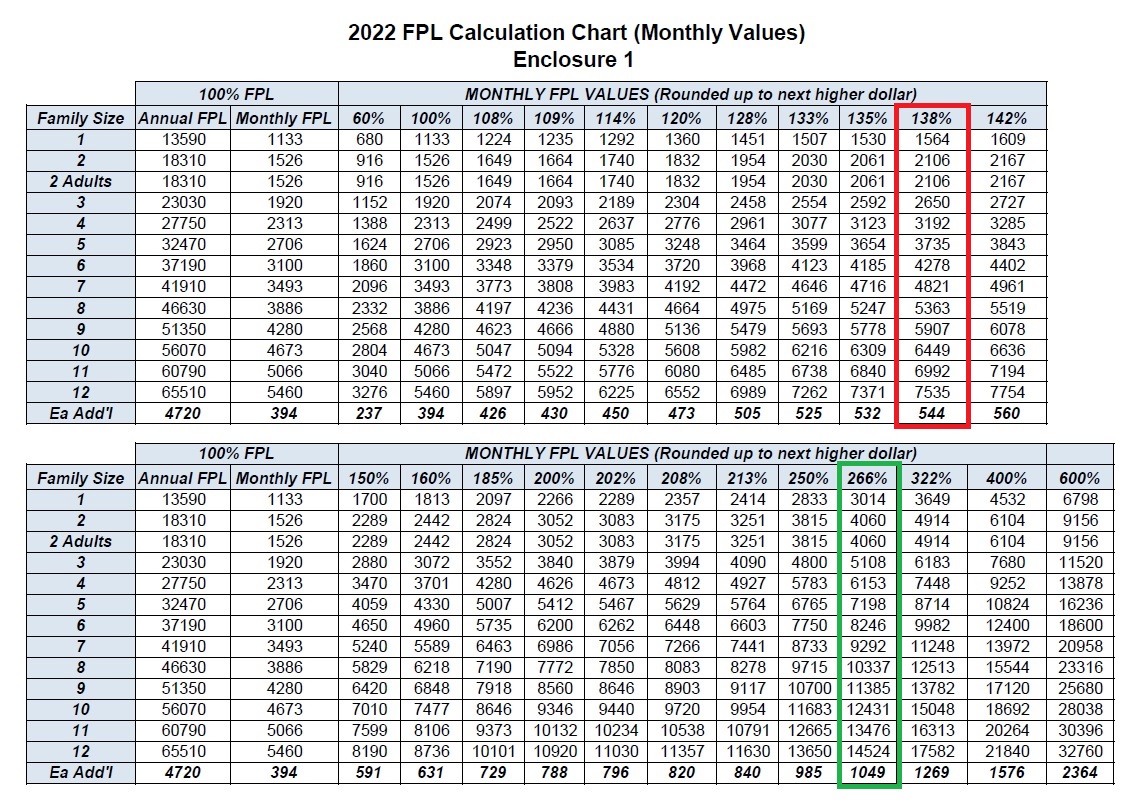

Big Increase For The 2022 Medi Cal Income Amounts

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Private Wealth Management In Sacramento Ca U S Bank

Rental Property Returns And Income Tax Calculator

Rental Property Returns And Income Tax Calculator

Income Tax Formula Excel University

Casio Mh 10 10 Digit Desktop Calculator Cost Sell Margin Walmart Com

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca